There are numerous decisions employees and employers must make when it comes to health care plans. One particularly common area of concern is handling HSA rollovers during the transition from one year to the next. Here's what to tell your employees.

HSA Rollover: The Basics

HSAs (Healthcare Savings Accounts) are popular with employees that subscribe to high-deductible health insurance policies. For 2023, a high-deductible health plan (HDHP) is defined as one whose minimum deductible is $1,500 for individuals and $3,000 for families. Employees often choose HDHPs if they are seeking lower monthly premiums, but the exact reasons may vary.

HSAs allow employees to invest money from their paychecks in order to fund future medical, dental, and vision treatments. HSAs are considered “triple tax free”- they are funded with pre-tax income, grow tax-deferred, and employees can withdraw from them tax-free so long as the funds are used to pay for eligible expenses. These funds are often critical for defraying the cost of expenses that are not paid by their insurance policies.

One key benefit of HSAs is that funds automatically rollover from year to year keeping past investments within reach to pay for future medical expenses. This is particularly important with regards to HSAs, as employees can only contribute a limited amount each year to their accounts otherwise.

Two types of HSA rollovers

1. Rollover HSA funds from the previous year: The “garden variety” HSA rollover requires no action on the employee’s part; the funds seamlessly shift from year to year and are available when needed. More importantly, the beginning of each new year resets contribution limits and lets employees begin adding funds to their accounts again.

2. Transfer HSA funds to a new account: However, in IRS jargon, an HSA rollover can have another meaning—the transfer of a balance from one HSA to another. In order to maintain the tax-savings benefits of the HSA and avoid a 20% penalty, you need to consider these two caveats as outlined by the IRS:

- Only one rollover is allowed per one-year period. It should be noted that this year starts the day you initiate the rollover by withdrawing funds from the original HSA. If you initiate the rollover on January 3rd, you won’t be able to rollover again until the same date next year.

- Once you initiate the rollover, you have 60 days to deposit the funds into your new HSA before risking taxation on the funds. Make sure you understand how you’ll receive the funds from the old account (check transfer or bank account) and how best to deposit the funds into the new account.

Tip: Employees can get around the limit of only one HSA account transfer a year by establishing a trustee-to-trustee transfer. Per IRS Publication 969: If employees instruct the trustee of their HSA to transfer funds directly to the trustee of one of their other HSAs, the transfer is not considered a rollover. There is no limit on the number of these transfers. Do not include the amount transferred in income, deduct it as a contribution, or include it as a distribution on Form 8889.

What do I tell employees about an HSA rollover?

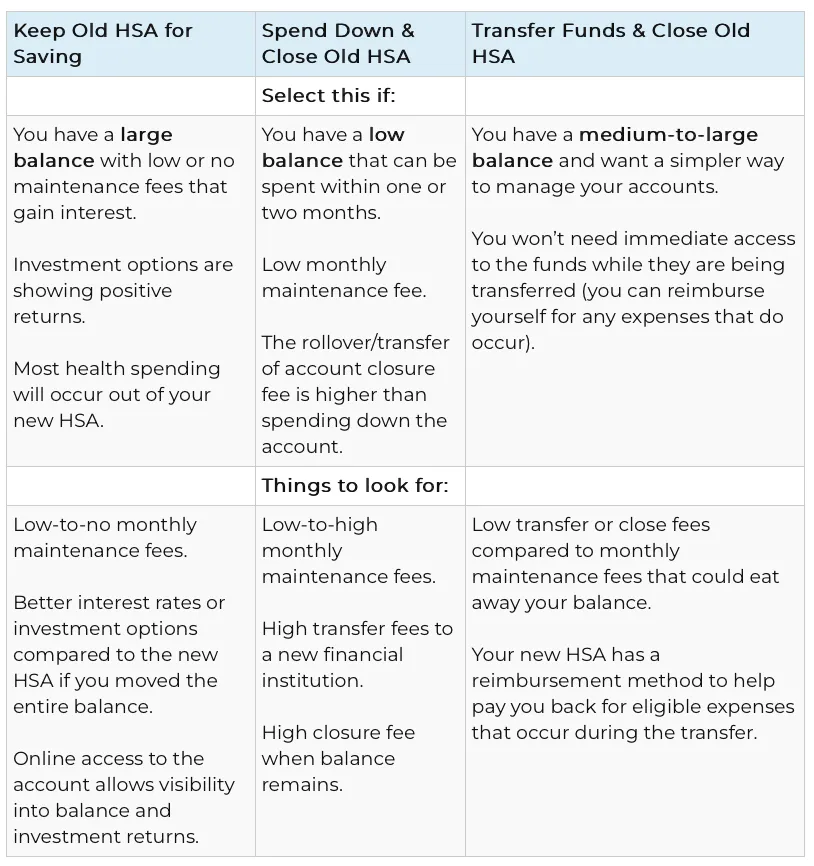

If employees are happy with their current HSA, they don’t need to do anything at all – their money is protected from taxes and their funds will continue to grow. Most importantly, the onset of a new year means that their contribution limits have been reset. In 2023, individuals can contribute up to $3850 and families can contribute $7750. However, if an employee is looking to rollover their HSA into a new, separate account, it’s advisable to inform them of the IRS’ stipulations, as well as to warn them about any potential fees they may encounter when withdrawing their balance. The following chart is a helpful resource to guide employees as they make a decision on whether or not to transfer their old HSA to their new HSA. You can download an infographic of the chart to distribute to your employees here.

Things to consider before transferring funds from an old HSA

Need help with HDHP and HSA Communications?

If you’re introducing a new High Deductible Health Plan (HDHP) or need help educating your employees about HSAs, we can help. Benefitfocus offers benefits decision support software and education to help your employees make better decisions. Contact Us to learn more.