Plan Year 2025: Integrated Decision Support Adds Value Across the Complete Benefits Picture

Benefitfocus understands that employees have a finite budget for where their hard-earned paychecks go – and both their health and financial goals can impact their annual benefits elections. We also know that when employees make decisions about their health and financial benefits separately, they may be poorly protected when it comes to their health and financial security.

That’s why personalized Decision Support is seamlessly integrated with Benefitplace, our enrollment platform. The experience provides data-driven guidance across health care and savings choices to help employees connect and optimize their benefits enrollment and savings decisions.

Heading Into 2025 with Benefits Confidence

We looked at data from customers using our enrollment platform for the plan year beginning January 1, 20251. It reveals that nearly two-thirds (65 percent) of the employees who started Decision Support completed the workflow – and were likely to take advantage of their personalized benefits options in ways that have the potential to promote improved health and financial wellness outcomes.

Of the employees who completed the Decision Support workflow,

- Over half (57 percent) elected voluntary benefits, compared with 45 percent of employees who didn’t use Decision Support. By enrolling in voluntary offerings, these employees may be better prepared to help manage health-related or other covered events.

- Over two-thirds (70 percent) of those electing a medical plan enrolled in a High Deductible Health Plan, compared with a 58 percent enrollment rate among employees who didn’t use Decision Support. This suggests that using Decision Support helps employees see the potential value afforded by High Deductible Health Plans and associated Health Savings Accounts (HSAs).

- 89 percent participation in Health Savings Account (HSA) when selected a HDHP, compared to 77% for those that didn't use Decision Support.

What Do These Insights Mean for Employers?

A guided benefits enrollment experience has the potential to improve an employer’s overall benefits program in three key ways.

Improves the employer’s benefits offering.

Employees may perceive benefits as complicated and may struggle to understand, select and use their benefits optimally. Voya consumer research reveals that employees consider employer and insurance provider online/digital tools (e.g., employee benefits enrollment portal) most important to make decisions about employee benefits2. It stands to reason that anything that simplifies the benefits experience for the employee has the potential to increase engagement with their benefits, and this is likely to reflect positively on their employer.

Improves the value of benefits across health and financial wellbeing.

It's not a stretch to suggest that employees who are better prepared financially may be less likely to be distracted by personal financial issues in the workplace – and they may appreciate their employer for being the source of this needed protection. And when a guided benefits enrollment experience can connect-the-benefit-dots for them, all the better.

Voluntary benefit offerings can play an essential role when it comes to optimizing benefits across the health-savings spectrum. Employees enrolled in such coverages as critical illness*, accident and/or hospital indemnity insurance, for example, may be better prepared financially to minimize the financial impact of a covered illness, accident or hospitalization. In fact, Voya research found that 85 percent of employees agree they take advantage of voluntary benefits offered at work and 83 percent feel more financially confident as a result of being enrolled in them2.

*Critical Illness may be referred to as Specified Disease in some states.

Improves employees' understanding of consumer driven health care.

As we pointed out in the 2024 State of Employee Benefits Report, a Voya Financial Consumer Insights & Research survey indicated an opportunity to educate working Americans on all the advantages of HSAs: only 3 percent of the working Americans surveyed understood the full benefits of HSAs by correctly selecting all options (compared to 2 percent in 2020). Furthermore, knowledge levels are (still) low and only slightly increased among those who own an HSA (5 percent), and those who have an account balance of $5k or more (8 percent)3.

HSAs can help contribute to employee financial wellbeing since they give access to triple tax savings: contributions are pre-tax when made via payroll deduction, earnings are tax-free and withdrawals for qualified medical expenses are tax-free. High deductible health plans with an associated HSA may not be appropriate for every employee, of course, but they may be a good option for many. An employer whose workforce is well-informed of their health care and savings options may be more likely to be engaged in their benefits management, and therefore have the potential to experience better health and financial outcomes that can help strengthen individuals and the organization.

The Benefitfocus Decision Support Solution Engages, Optimizes and Inspires

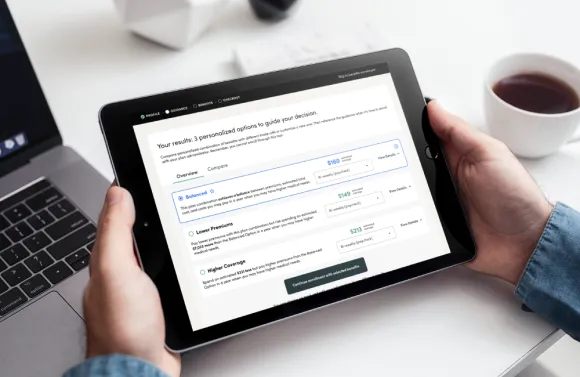

What makes our decision support solution unique is that it offers unbiased guidance across a robust set of benefits: not just major medical plans and health care savings/spending accounts, but also dental, vision and voluntary benefits including critical illness, accident and hospital indemnity insurance.

By estimating employees’ household health care needs, Decision Support generates scenarios based on the employee’s risk profile and proposes appropriate benefit packages structured to minimize out-of-pocket costs in an average year and mitigate risk of large out-of-pocket costs in a year where utilization is higher than expected.

The goal is to help employees:

- Avoid decision fatigue and guesswork

- Balance health care costs with expected needs

- Prepare for their financial future

And employers? They’re better able to realize the full value of the investment they’re making in their people.

Learn more about the Benefitfocus personalized Decision Support solution.

1Among select client groups using personalized enrollment guidance functionality in Benefitplace™ fall 2024 annual enrollment period for 1/1/25 benefit effective dates.

2Based on the results of a Voya Financial Consumer Insights & Research survey conducted September 27th - October 7th, 2024 among 345 adults aged 18+ Americans, working either Full-time or Part-time, who have primary or shared household responsibility for making financial and health/medical plan decisions, are benefit eligible for employer-sponsored retirement and health plans and currently enrolled.

3Voya Financial Consumer Insights & Research survey conducted with Morning Consult between March 9-15, 2023 among n=500 working Americans age 18+ who have both an employer-sponsored retirement plan and a medical/health plan, featuring n=188 health savings account owners.

This material is not legal advice and is provided for informational purposes only.

The projections or other outputs of the Benefitplace decision support experience regarding the likelihood of various health costs, spending, and investment outcomes are hypothetical in nature. They do not reflect actual health costs and spending or investment results and are not guarantees of future results. Benefitplace does not provide tax advice.

Voya Financial and its affiliated companies (collectively, “Voya”) is making available to you the Decision Support tool offered by SAVVI Financial LLC. (“SAVVI”). Voya has a financial ownership interest in and business relationships with SAVVI that create an incentive for Voya to promote SAVVI’s products and services and for SAVVI to promote Voya’s products and services. Please access and read SAVVI’s Firm Brochure, which is available at this link: https://www.savvifi.com/legal/form-adv. It contains general information about SAVVI’s business, including conflicts of interest.

CN4115621_1226