The small group market is the backbone of every health plan. Yet, this market is undergoing unprecedented levels of disruption.

- Regulatory changes resulting in profound impact on offerings, pricing and costs

- Digital advancements aimed at meeting the needs of healthcare consumerism

- Increased competition from Insurtech entrants and alternative models

- Employee-centric benefits and a shift away from traditional health insurance

- Flexibility and personalization leading to increased demand for variety of plan options to attract and retain employees

- Cost management strategies leading to increased adoption of HDHPs/HSAs and alternative funding models like ICHRA and Level-funded coverage

The introduction of Individual Coverage Health Reimbursement Arrangements (ICHRAs) is unlocking a new wave of consumerism and changes for health plans to address. While many plans are still trying to understand what ICHRA will mean for their business, others are going all in on ICHRA as a key component of their growth and retention strategies.

Why should you be considering taking an active role in making ICHRAs available to your brokers and group clients? Do you remember when the 401k first hit the market? They replaced pensions because they gave employees and employers greater choice and flexibility. We invite you to think about ICHRAs in the same way. The evidence suggests that ICHRAs may be poised to transform healthcare the way 401Ks transformed retirement is overwhelming1.

ICHRA Growth Is Picking Up Steam

If your health plan has chosen to take an active role offering ICHRAs to group customers, it is likely you are already aware that other carriers and insurtechs are focused on this market as well. Their strategy is to capture your group business — especially small group. Skeptical health plans may not yet be aware they may be losing market share and could be at risk of losing significant business in the next few years if they don’t develop a more proactive strategy. If your organization is avoiding ICHRAs, here’s why you may want to reconsider your approach.

Recent headlines:

- Insurers, startups see opportunity in exchange-based HRAs

- ICHRAs and the Explosive Growth of Personalized Health

- ICHRA is having a moment. VCs are taking notice and looking to invest in the emerging space

- Small and midsize companies look for health care options with fixed costs

- Small Employers Take Advantage of ICHRAs to Lower Their Employees’ Health Care Costs

Momentum Is Building for Accelerated Growth Opportunities

A comprehensive ICHRA strategy can power growth for your health plan. And there is plenty of evidence to support it. According to the 2024 HRA Council Data Report:

- ICHRAs grew 84 percent among applicable large employers between 2023 and 2024.

- 80 percent of startups and very small businesses renew ICHRAs YOY.

- ICHRA adoption grew 29 percent YOY between 2023 and 2024.

- 83 percent of employers offering an ICHRA or QSEHRA have not previously offered employees coverage.

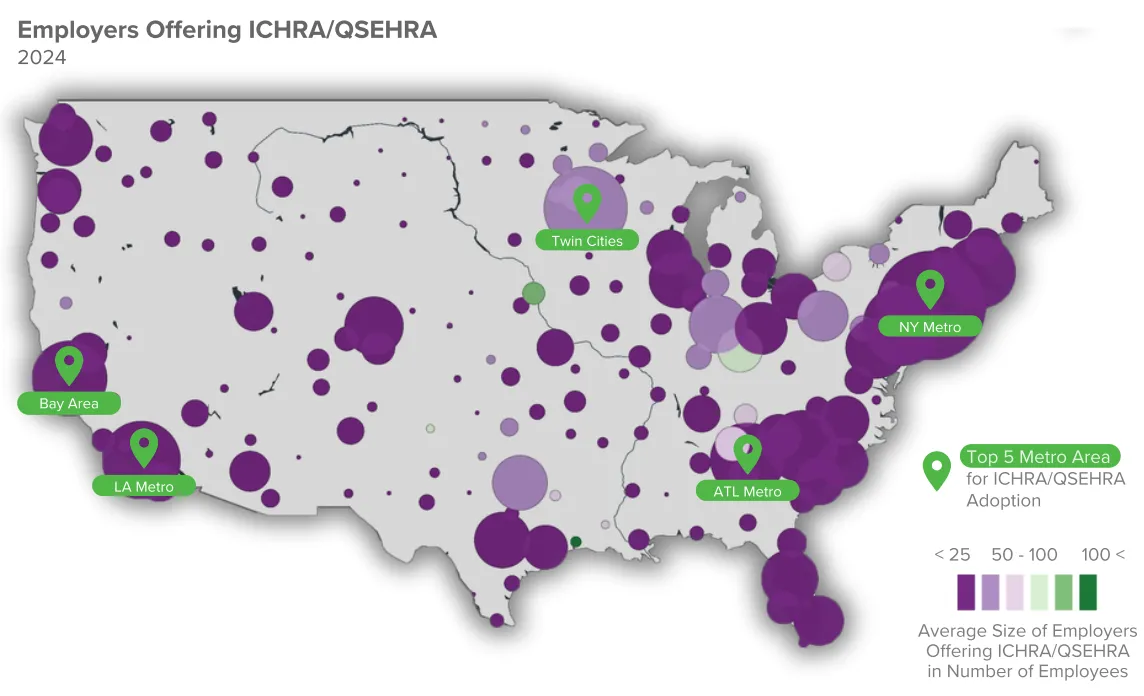

MAP: 2024 HRA Council Data Report: Growth Trends for ICHRA & QSEHRA Volume

A look back since ICHRAs were introduced in 2020 shows just how quickly this market has grown. Since 2021, the number of states with ICHRA availability grew by 26 percent, up from 19 states in 20212. The COVID-19 public health emergency expanded ICHRA notice relief for employer groups in 2022. In 2023, over half of the states had ICHRA favorability with individual rates being more affordable than group rates, and adoption increased 64 percent from 2022 to 20233.

In 2024 ICHRA/QSEHRA is showing a high retention rate4, and the IRS lowered the affordability requirement from 9.12 percent to 8.39 percent of employees’ household income5. Things are evolving rapidly.

Beginning to Offer ICHRAs is Easier Than You Think

Offering ICHRAs independently can be complicated with limited IT resources, regulatory complexity and data protection mandates. Additionally, there is the ongoing burden of maintenance of home-grown systems that become exponentially expensive as technology advances. For health plans attempting to offer ICHRA on their own, scalable and compliant ICHRA offerings will weigh heavily on ROI for technology and resources. The right technology partner can position your health plan to get to market quickly and capitalize on ICHRA to fuel your growth.

The Solution: A Fully Integrated Technology – and Strong Service – Solution

Given the need to constantly maintain systems and address changing regulations, building internal systems is a tough choice for today’s health plans. At Benefitfocus, we focus on solving big-picture problems to better connect the benefits experience – so health plans can have greater impact in the communities they serve. A health benefit platform that supports the full quote-to-pay lifecycle is the ideal solution to grow at scale. And when it comes to ICHRA, we believe the right solution – for health plans, their brokers, and employers – should do three things well:

- Offer the best of the group experience, while offering individual employees a consumer shopping experience to protect your membership.

- Deliver high degrees of automation and services to limit administrative burdens for health plans.

- Support group brokers to help employers take advantage of ICHRAs, while maintaining their relationship with the group employees and their commission.

That’s why we developed our solution specifically with the needs of our health plan customers, their brokers and customers in mind. It starts with enabling you to go to market with new solutions quickly, with digital tools for brokers to help your mutual customers succeed. It also involves providing a level of service excellence based on a deep understanding of your organization and a shared commitment to achieving your goals.

Working with Benefitfocus can help your health plan:

- Manage the entire quote-to-pay lifecycle for all your commercial product lines, from a single technology ecosystem that’s maintained and continuously evolving.

- Enhance and maintain your relationships with brokers with a solution that will reinforce their valued-added role, and give them the flexibility across their book of business

- Create meaningful connections with your members, brokers, and employer groups year-round through an engaging and hyper-personalized experience.

- Simplify administration, drive efficiencies and enable you to focus on what’s most important.

- Harness powerful data-driven insights to help you identify key cost drivers and improve member health outcomes.

There’s no denying that health plans need a way to respond quickly (and competitively) to the ICHRA opportunity. To find out more about how Benefitfocus can help your health plan, book your free demo today.

The information provided does not, and is not intended to, constitute legal or tax advice and is not intended to address the situation of any plan, group or individual; instead, all information and content herein is provided for general informational purposes only and may not constitute the most up-to-date legal or other information.