Careful analysis of the Benefitfocus 2024 State of Employee BenefitsTM (SoEB) research has been underway for months. The team has been analyzing our proprietary platform data – not to mention a wide range of industry-sourced data – to put together a comprehensive look at what’s trending in the world of employee benefits and why it matters. Our aim is to help employers, benefits brokers and health plan leaders understand what’s making the marketplace “tick” so they can develop winning strategies for the benefits year ahead.

Here are 3 of our key findings:

Employers Need to Enable Employees to Make Optimal Health Plan Selections

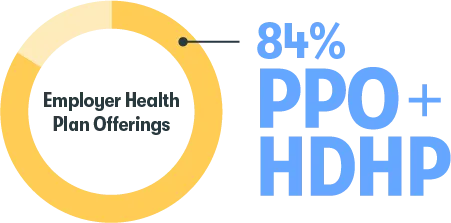

Our research confirms that one trend is here to stay: to meet the needs of an increasingly diverse workforce, most employers (84 percent) offered their employees a combination of both traditional health plans and high-deductible health plans (HDHPs) for plan year 2024 (starting 1/1/24).

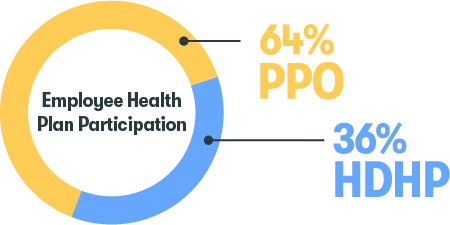

While employees continue to enroll in traditional plans in a higher proportion than HDHPs when both types of plans are offered (64 percent and 36 percent, respectively), enrollment in HDHPs is increasing across all generations year over year.

The question for employers is no longer, “Should we offer employees a choice of health plans?” but rather, “How can we make sure each employee enrolls in the right health plan for their needs?” While it’s nearly impossible to know how many people are enrolled in a sub-optimal health plan for their needs, employers need to assess whether their enrollment expectations are being met. The report provides questions employers can ask themselves to help determine if their health plan benefits strategy is meeting their employees’ – and organizations’ – goals.

While most people know what to look for in a health plan, they may not know if they’re making the right choices, from enrollment through utilization. The potential consequences of their choices vary by organization and individual, of course, but when taken together, can negatively impact the collective state of employee benefits for years to come. As discussed in the report, employers are eager to provide their people with holistic guidance and better benefits enrollment support that spans the benefits mix across health and financial wellness – so employees can optimize their selections.

Employers Need Solutions to Help Employees Across All Generations Manage Their Health Care Costs

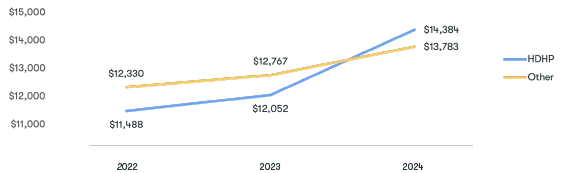

Average total premium across all coverage types continues to rise year-over-year.

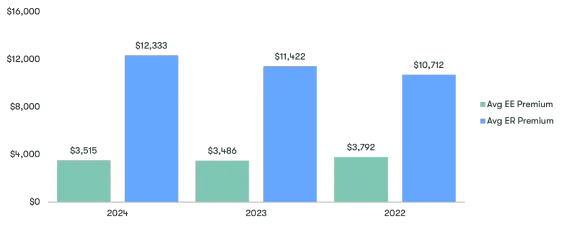

For plan year 2024, the average employer share of premium increased to over $12k, reflecting an increasing shift of premium share to the employer over the last 3 plan years.

Today’s story around health care plan costs is not that the costs continue to rise or that employers need to continue to strike the right cost-sharing balance to keep employees satisfied. The fact is employers have been grappling with rising costs – and how to manage them – for decades. They have a well-seasoned understanding that health coverage costs are shaped by a variety of factors, only some of which are in their control.

Employers are managing costs in a variety of ways, including medical plan and benefits design (e.g., network architecture and copay methodologies), employee wellbeing engagement and education (e.g., wellness incentives and health care navigation and concierge) and industry partnerships and pricing arrangements (e.g., reference-based pricing and mitigating waste and abuse in health care spend). For their part, as shown in the report, employees are also taking actions to manage current and future health care costs.

The report explores employers’ opportunity to try a targeted “meet employees where they are” approach to benefits education and communications. This involves accessing workforce surveys and benefits data to understand generational preferences and trends while developing benefits strategies and setting goals. Putting data to work can help benefits leaders better evolve their benefits programs, maximize ROI and innovate.

Employers Need to Help Employees Make the Connection Between Health Care and Savings

The percentage of employers offering HSAs and/or FSAs dropped by 3.7 percent from plan year 2022 (81 percent) to plan year 2024 (78 percent) and employee participation in HSAs and/or FSAs (among employees with a health plan offer) declined 20 percent from plan year 2022 (25 percent) to plan year 2024 (20 percent).

Our data shows offering and participation trends for the most popular consumer-driven health care savings vehicles, HSAs and FSAs – and the report reveals some interesting generational nuances. But the most significant takeaway is that for employees to realize the full value of consumer-directed health care, employers need to raise awareness of HDHP/HSA programs and their advantages – and provide their people with effective health care and savings resources, including a decision support tool, to help them manage their benefits and health care dollars.

In any discussion about consumer-directed health care, it’s critical to establish that employees need to enroll in the right type of health plan for them to make optimal health care savings decisions. For a typical U.S. adult, choosing health care benefits is among the most significant decisions they’ll make across their working lifetime – decisions that have a clear impact on two of the most important life areas: current and long-term health and financial wellness. Yet for the most part, health care and financial wellness benefits are thought about, managed and selected in silos, as though they weren’t associated at all.

When making decisions about their health care and financial benefits separately, employees are at risk of being left poorly protected with respect to their health and financial security – and employers are unable to realize the full value of the investment they’re making in their people. Employers are in the ideal position to help their employees to understand the interdependence across health, retirement and savings – and how one choice might impact another. So whether an employee selects a PPO plan or an HDHP, they can make benefits decisions that meet their unique health care and savings needs.

Ready to learn more?

These insights are just the tip of the iceberg. The 2024 State of Employee Benefits Report and its supplemental assets contain so much more about health care plan offerings and enrollments, health care plan costs, consumer-directed health care and voluntary benefits – and include rich context around the whys, hows and what-to-do-nows. Access all of the State of Employee Benefits insights now!

The State of Employee Benefits 2024 was compiled from enrollment transactions aggregated across 316 large employers (1,000+ full-time employees) within the Benefitfocus customer base, representing more than 1.8 million employees in total. The data, accessed in March, 2024, was evaluated on an anonymous basis. Enrollment records include both active and passive enrollments made by a variety of industry roles (employee, carrier representative, broker, benefits administrator, etc.) from the fall of 2021 through fall of 2023 for plan year effective dates of January 1. These measurements are not meant to be a nationally representative sample, but to represent the aggregate activity for large employers on the Benefitfocus platform.

“Family coverage” is defined as coverage levels that had at least one employee, one spouse/domestic partner and one child. For premium metrics, all averages are annual premium amounts. All dollar amounts have been rounded to the nearest whole dollar. All percentages, with limited exceptions, have been rounded to the nearest whole number within the report and single decimal within the appendix. Subscribers 17 years of age and younger have been removed. The data for insufficient sample sizes has been withheld.

Benefitfocus has provided this as an educational resource. This is for informational purposes only and not intended to provide advice or address the situation of any individual or entity. The topics addressed may have legal, financial, and health implications, and we recommend you speak with a legal, financial, or health advisor before acting on any of the information presented.

Benefitfocus is not an actuarial firm, and Benefitfocus is not acting as an actuary or determining any actuarial basis for employer benefit offerings. Benefitfocus does not underwrite insurance and does not give legal advice regarding the adequacy of coverage limits or types. The State of Employee Benefits Report is not a substitute for the advice of an attorney, tax, actuarial or other professional advisors.