When examined alongside insights from industry research and best practices, our 2024 State of Employee BenefitsTM Report data revealed some interesting generational trends that HR leaders can use to better understand their employees’ needs and implement competitive benefits programs.

The Benefit Manager’s Challenge: Five Generations in the Workforce

The topic of managing a multigenerational workforce is nothing new. In fact, generational theory has been fascinating people (and even sparking controversy) for over a century. As the world changes with the passage of time, new generations enter – and inevitably influence – the workplace and there's always something new to learn. In the HR realm, headlines like Can 5 Generations Coexist In The Workplace? and What to Know When Five Generations Share an Office continue to catch our attention.

Change is constant, but keeping up with it is an important part of a successful benefits strategy in an age when employee expectations continue to rise. Understanding generational differences, while inherently nuanced and always evolving, can help employers take better care of their employees. When new data comes to light, it’s worth some careful reflection.

2024 SoEB Report: Generational Trends

Below are data points related to health plan and voluntary benefits participation as well as health care costs and savings accounts. Note that the full 2024 State of Employee Benefits Report contains additional and more detailed generational data and insights.

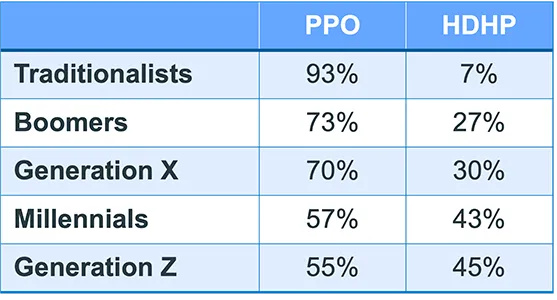

Health Plan Participation When Both PPOs and HDHPs Are Offered, Plan Year 2024

Across all generations, employees continue to enroll in traditional plans (PPOs) at a higher rate than HDHPs, and more than half of employees are still choosing traditional plans. Between plan years 2022 and 2024, when both PPOs and HDHPs are offered, participation in PPOs decreased slightly, shifting to participation in HDHPs. HDHP participation is highest among Generation Z and lowest among Traditionalists.

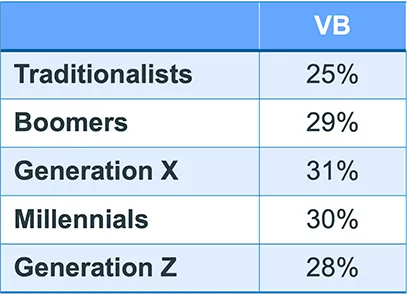

Voluntary Benefit Participation, Plan Year 2024

Across accident, critical illness*, hospital indemnity, identity theft, legal and pet benefits, Generation X has the highest participation overall, followed by Millennials and Baby Boomers. Traditionalists have the lowest participation in these benefits.

*Critical Illness may be referred to as Specified Disease in some states.

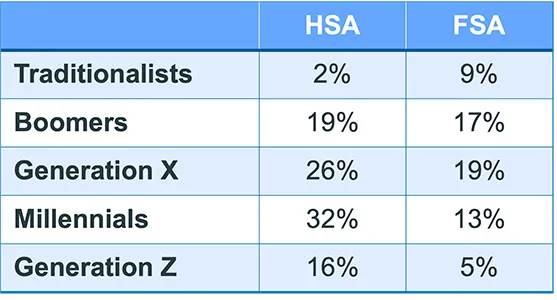

HSA and FSA Participation Rates, Plan Year 2024

Participation in HSA plans is higher than FSA plans across all generations except Traditionalists. Millennials had the highest rate of participation in HSAs and Generation X had the highest rate of participation in FSAs.

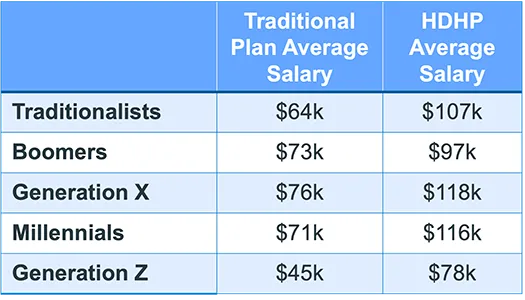

Average Salary by Generation and Plan Type, Plan Years 2022-2024

Across generations, higher salaried individuals choose HDHPs over traditional plans when both are offered.

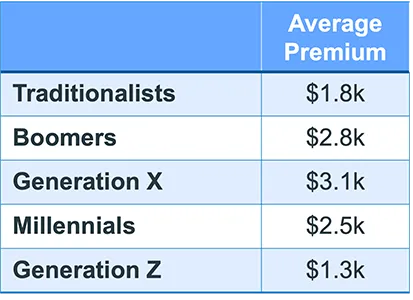

Average Employee Premium, All Plan Types, Plan Year 2024

Generation X has the highest premiums compared to other generations, across all plans, and Generation Z has the lowest.

5 Actionable Takeaways from the SoEB’s Generational Insights

1. Let Your Workforce Guide Your Strategy

There’s not always a simple, let alone single, answer to “why” generational trends emerge in a dataset or “what they mean” to a particular workforce. Our SoEB findings are an aggregate of over 300 clients – handy for benchmarking, but not necessarily reflective of your employee base.

That’s why it’s important to understand what your employees are looking for in a benefits program – and how you expect your program to perform by way of enrollments, utilization and even cost savings. As a result of knowing your employees, trends in your benefits data can take on greater meaning and it may be easier for you to discern whether your benefits offerings and communications are meeting their needs and your organization’s goals.

2. Take the Opportunity to Get to Know Your Employees

Formally checking with employees to get feedback on your benefits programs is one of the best ways to know if your benefits are meeting their needs and expectations – no matter which generation they belong to. (That said, slicing and dicing your results by generation is a great way to spot insight-packed generational trends!) If you're not already asking employees what benefit offerings would add value to their life – and drive satisfaction with your employee benefits package – start now. A simple survey will help you quickly spot trends and prioritize products and solutions, such as caregiver benefits or a mental health app, to add to your benefits lineup.

Other best practices include creating feedback loops between employees and their managers and HR team, getting to know employees and their needs though Employee Resource Groups and leveraging benefits data collected by your benefits administration partner.

Learn more in the Get To Know Your Employees Better Playbook!

3. Emphasize Strategic Communications to Engage Employees

Looking through a generational lens at what your employees value in benefits and how they prefer to communicate about benefits is an excellent way to design a benefits communication strategy. While you want to avoid stereotyping and pigeonholing employees (see point 4), bear in mind that different people communicate differently. Using multiple channels to communicate with employees – and even enabling employees to select their preferred channel(s) – will help ensure your messages reach everyone in a way that’s convenient and resonant.

Explore more in Your Mini Guide to Measuring Employee Engagement with Benefits Communication.

4. Then Again, Be Careful to Not Define Employees by their Generation

Employee benefits needs are multivariate. To some extent, an individual’s generational cohort can inform what they’re likely to “look for” or value in a benefits package. In their 2024 Employee Health & Benefits Trends Report, Marsh McLennan shares one perspective:

- Gen Z struggles with work-related burnout and wants support via robust mental health benefits.

- Millennials see their student debt as an impediment to financial health and want employers to help lighten the load.

- Gen X wants the time flexibility to attend to their family responsibilities — caring for elderly parents and their children.

- Boomers are approaching retirement, and like all the help they can get in achieving financial security before leaving the workforce.

These are just starting points, of course, and don’t tell the full story of any one employee’s unique benefits needs. When you consider that a person’s age is but one factor among many that may shape their expectations at work (e.g., geography, income, gender identity, job level, race, health status, family status), you can help make sure that your benefits communications don't paint anyone into a proverbial corner.

The bottom line is to be both inclusive and thoughtful about your messaging and channels. While you can assume that most Boomers don’t need fertility benefits, don’t assume that they’re not interested in a robust mental health offering. And just because younger employees tend to raise their hands for social media, texts and IM communications, don’t assume that their older counterparts aren’t interested.

5. Provide Employees with a Connected, Guided Benefits Experience

One thing that everyone can agree on? The commonsense notion that managing benefits should be easy and convenient for benefits administrators and employees. That’s great news, because it would be quite a heavy lift for benefits teams to develop different benefits enrollment, education and communication strategies for each employee demographic. A user-friendly enrollment experience – one that’s personalized and offers decision support to help employees to consider their core and supplemental health care and financial wellness offerings side-by-side – can go far in helping people meet their unique needs.

Ready to learn more?

These insights are just the tip of the iceberg. The 2024 State of Employee Benefits Report and its supplemental assets contain so much more about health care plan offerings and enrollments, health care plan costs, consumer-directed health care, voluntary benefits and claims behavior – and include rich context around the whys, hows and what-to-do-nows. Download the report now!

The State of Employee Benefits 2024 was compiled from enrollment transactions aggregated across 316 large employers (1,000+ full-time employees) within the Benefitfocus customer base, representing more than 1.8 million employees in total. The data, accessed in March, 2024, was evaluated on an anonymous basis. Enrollment records include both active and passive enrollments made by a variety of industry roles (employee, carrier representative, broker, benefits administrator, etc.) from the fall of 2021 through fall of 2023 for plan year effective dates of January 1. These measurements are not meant to be a nationally representative sample, but to represent the aggregate activity for large employers on the Benefitfocus platform.

Benefitfocus has provided this as an educational resource. This is for informational purposes only and not intended to provide advice or address the situation of any individual or entity. The topics addressed may have legal, financial, and health implications, and we recommend you speak with a legal, financial, or health advisor before acting on any of the information presented.

Benefitfocus is not an actuarial firm, and Benefitfocus is not acting as an actuary or determining any actuarial basis for employer benefit offerings. Benefitfocus does not underwrite insurance and does not give legal advice regarding the adequacy of coverage limits or types. The State of Employee Benefits Report is not a substitute for the advice of an attorney, tax, actuarial or other professional advisors.

Benefitfocus is a Voya Financial® company.

CN3616822_06026